Why Choose Us

10 Reasons to Choose BergerCPAFirst

Know exactly where your

business is standing.

We deliver timely and accurate financial statements to hundreds of small businesses on a monthly or quarterly basis and we can do the same for you.

Know what your

accounting costs will be.

Our accounting services are provided for an affordable fixed fee and you know upfront what your costs will be during our appointment.

A dedicated team to handle

your accounts

On engagement with us, a competent team headed by an Account Executive will take care of your interests & respond on a priority basis through a phone call or email. With more than one individual taking care of your needs, you can be sure of continuity & timely responses.

Don’t pay for an

extra 15 or 20 minutes phone call.

As part of our fixed monthly fee, you receive unlimited consultation on accounting and tax matters over the telephone or in our office. We do charge extra for large or special projects, but we will tell you of that in advance and give you an estimate of the cost

Don’t pay accountant

rates for bookkeeping services.

Most CPAs don’t enjoy doing bookkeeping and quite frankly, aren’t very good at it. We will assign you a full-time bookkeeper to do your bank reconciliation and prepare your monthly financial statements. Each of our bookkeepers has a technical degree in bookkeeping with strong academic grades and comes on board with several years of practical experience dealing with small businesses like yours.

Get the best possible answers

to your small business questions.

We have been working with hundreds of small businesses in several dozens of industries and have been answering their small business questions for over fifteen years. Chances are, we will have heard and answered any small business question you have, many times before. Hopefully, we will have not only an answer but the answer that has provided to be most profitable to our clients in past.

We make sure you don’t

get IRS penalties and notices.

We will prepare your payroll and sales tax returns and make sure you know the proper amounts to pay and when and how to pay them. If you do receive IRS notices, we will respond to them at no cost to you.

You don’t want to talk about GAAP

and FASB rules and IRC SEC XXX (B).

We speak ordinary English. Sure, we know all of those terms, but our job is to make sure you know how to make money and saves taxes, and we pride ourselves on being able to clearly communicate our ideas to you.

You deserve to

be treated like a first priority client.

All of our clients are small businesses, ranging in size from start-ups to $100 million in annual sales. We can’t afford to treat the small business client as anything but a first-class client, because they are the only clients we have.

Avoid getting a

surprise tax bill on April 15th.

We provide you with monthly financial statements that let you constantly monitor your tax bill. In addition, we encourage each of small business clients to meet us each fall to estimate their tax liability.

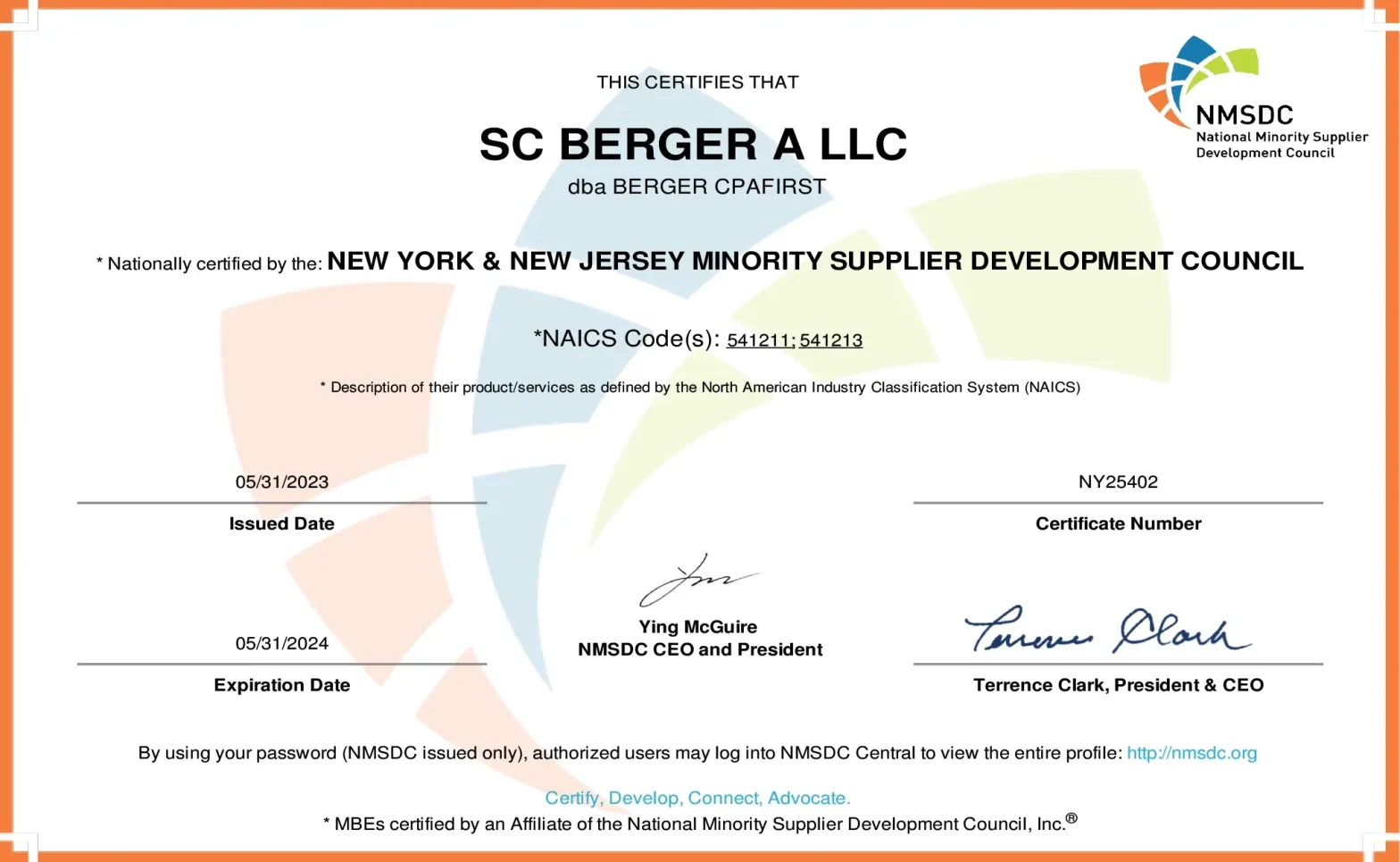

Awards

Testimonials

BergerCPAFirst is an invaluable financial partner that is crucial to our company’s success. I confidently recommend their services to businesses seeking expert accounting and financial advice.

We were looking for someone who could explain our taxes and work with us to ensure that we understand our taxes and file everything on time without filing extensions. We have been using this firm for the past 8+ years now for our bookkeeping, payroll, sales tax, business & personal taxes, and highly recommend. Ravee and Ramki team are truly professional, friendly, and honest. What more could we ask for. SO WORTH IT!

Highly recommend using them for CPA services, after using several different firms in the past we have never been happier with their services and their dedication to providing the best care for their clients!

Words cannot express how amazing this firm is. The knowledge, kindness, professionalism, and expertise in tax law and processes are beyond amazing. The staff is very friendly and supportive and they really make you feel comfortable and provide peace of mind. I highly recommend BergerCPAFirst for your accounting and tax purposes.

As a result of my accountant retiring, I was referred to BergerCPAFirst and I cannot express enough how satisfied I am with their services. Their attention to detail as well as thorough explanations of what is being done keeps me at ease and secure that my businesses are in good hands. The prompt responses whenever I have a question also is a help as well. I know with them I don’t have to worry, and things are being handled within the timeframes needed. Their staff are all polite and courteous and make sure messages get to the correct people. I recommend their firm, you won’t regret it.

I was dealing with two CPA for book keeping and another for filing taxes. I am very pleased with service provided by BergerCPAFirst for last 3 yrs. for everything they have done for me. Big thank you.

Absolute professionals and was exhaustively advised on all things tax planning and business entity structure set up. Extremely detail oriented and always feel confident that you are in good hands. Personalized attention along with a strong team backing. Highly recommend Berger CPA!

The team at Berger CPA has been very helpful in our transition to a new accounting firm. They’re wise respectful people and we hope to continue in the positive trajectory we have experienced with Ramkee, Ravee, Natalia, Rob and the rest of the team.

It’s always a great experience working with Berger CPAFirst. Their team is very attentive and quick to resolve all my accounting needs. Berger CPAFIRST has helped my business grow tremendously and kept me in compliance. I highly recommend them.

The Berger CPAFirst team really does a great job with small business accounting. They are great at communicating everything and keeping me updated on my monthly financial statements! The staff is excellent and really go out on a limb to assist you with any query.

The best CPA’s in New Jersey! They did my taxes in a very short time and they are really professional. Natalia and Nicole are so friendly.

I’ve been doing taxes with Sam since 2012. He and his team and do excellent work across all my businesses. Sam provides tax guidance and corp structuring strategy as part of his services scope, which is something that sold me initially, and he has not disappointed over the years. I highly recommended Sam and his network of professionals to any small business owner.

Very grateful for what you guys have done for my business. You’ve been a pillar of our organization in helping us organize our taxes legally and financially. Everyone at the firm is a pleasure to work with. They have exceeded our expectations. They guided us to get the PPP loan during this difficult time of Covid 19. We highly recommend for any small business or well established firms reaching out for their bookkeeping and taxation needs.

As a small business owner of a landscaping company, I have been working with BergerCPAFirst for 2 years now and it has been such smooth sailing that I now bank upon these guys easily for all my tax and financial planning.

Client Login

Client Login